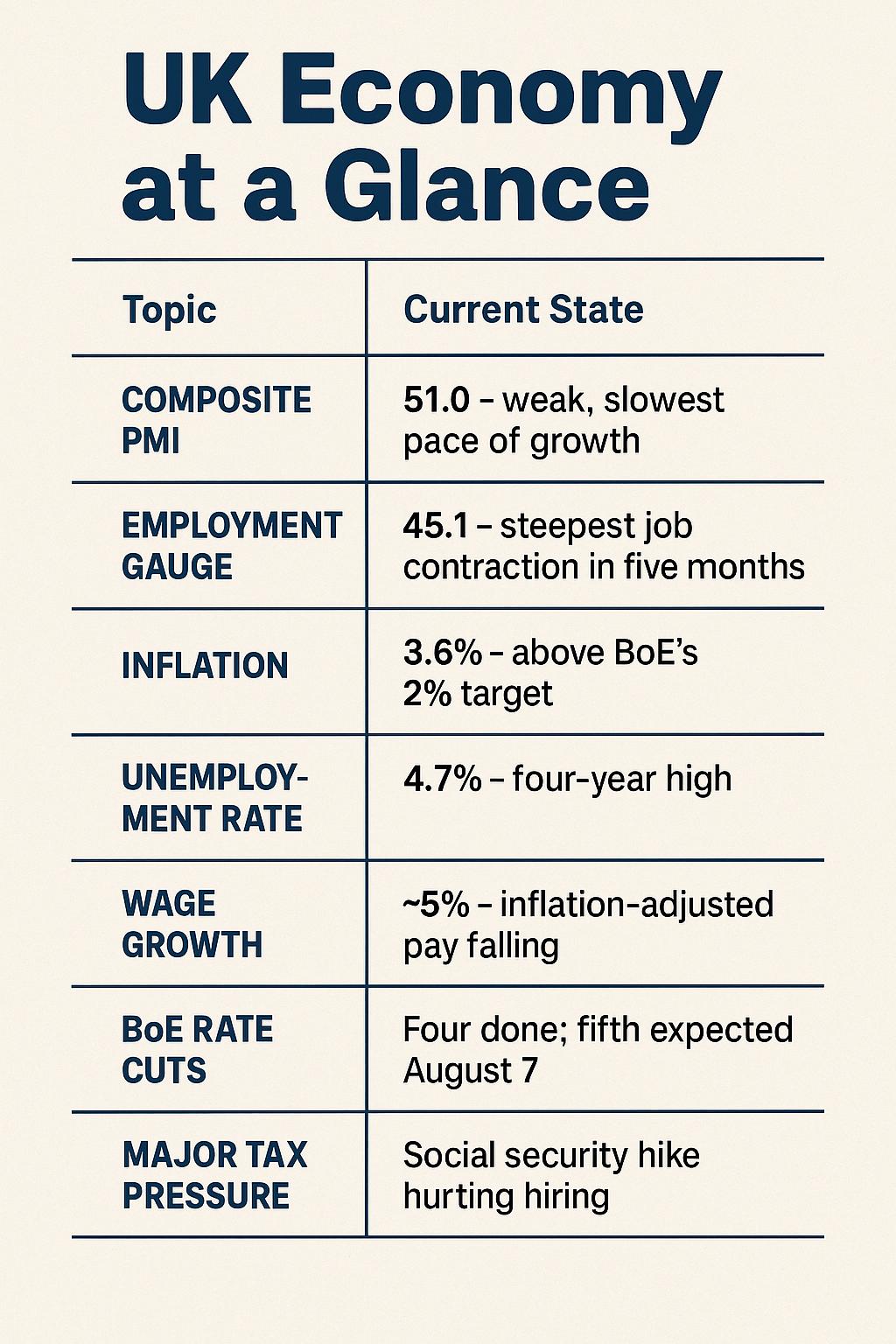

As the a latest updates Bank of England (BoE) prepares for its pivotal August 7 meeting, new data show UK businesses hitting a wall. Activity growth is minimal, hiring intentions have slumped, and headcount reductions loom large—painting a disconcerting picture for the nation’s post-pandemic economic retrieval.

PMI Slips, Job Market Weakens

S&P Global’s July Composite Purchasing Managers’ Index (PMI), a key gauge combining manufacturing and services, slipped to 51.0—just above the 50‑point growth threshold and down from 52.0 in June. While technically still progressive, this barely‑ahead‑of‑flat reading signals stagnation rather than expansion, and markedly underperformed market expectations.

terrible things come when, the employment gauge jump to 45.1, marking the abrupt contraction in last five months. A number below 50 denotes declining payrolls, indicating that employers are shedding staff amid weak demand rather than hiring.

Many firms have flagged higher National Insurance (social security) contributions imposed in April as the chief culprit for squeezing margins and curbing ability to maintain or grow headcount.

Growth Painted in Faint Colors

S&P estimates show the United Kingdom’s economy expanding at nearly 0.1% in Q3, instead of perilously close to contraction. With the service PMI just over 51 and manufacturing still mired at 48.2 after nearly a year of contraction, the aggregate outlook is fragile

The manufacturing sector, while slightly better than June’s 47.7, has now contracted for ten consecutive months—underscoring deeper structural issues such as global supply chain disruptions, mounting cost pressures, and muted investment.

Inflation vs. Weakness: The Central Bank’s Dilemma

Inflation remains stubbornly above target at 3.6% in June, frustrating the BoE’s mission to bring it down to 2%. At the same time, employment and growth indicators are weakening—placing the BoE in a policy bind.

As S&P economist Chris Williamson put it:

“Higher staffing costs have exacerbated firms’ the current payroll disruption is based on weak environment from the demand side issue , resulting cascading effect in another month of sharply reduced headcounts in July.” – Source : Reuters

As per the market expect discussion the BoE to proceed with a fifth interest rate cut next month. The bank has already eased rates four times since July 2024, and weakening labour data further tilts the balance toward additional cuts—even if inflation remains elevated.

However, BoE Governor Andrew Bailey has cautioned that the labor market slowdown reduces inflation pressure—but stressed the bank will remain vigilant, mindful of global uncertainties. Another internal voice, policymaker Alan Taylor, warned the UK’s soft landing is at risk, noting data support five rate cuts in 2025 rather than four.

The Wage–Price–Tax Squeeze

UK wage growth has cooled to about 5%, trailing inflation, which cuts into real incomes and dampens consumer demand. Firms are absorbing increases in taxes and wages by passing costs downstream—marking the first rise in prices charged by businesses since April 2025.

The social security hike implemented in April has been a flashpoint. Employers report it’s eating into profitability and driving staff layoffs. Payroll data confirm a drop of approximately 178,000 jobs year‑on‑year, with unemployment rising to 4.7%, its highest level since mid‑2021.

Consumer spending, which has supported UK growth in recent post‑pandemic months, appears to be softening. That spells caution ahead for sectors heavily reliant on domestic demand—retail, hospitality, and leisure.

Policy Pressure on Government and Central Bank

This strain on businesses and households comes amid calls for policy adjustments—from both political and private sector leaders.

Chancellor Rachel Reeves, facing criticism for higher taxation, described existing rules as a “boot on the neck” of businesses In contrast, Lloyds Banking Group CEO Charlie Nunn warned against imposing further financial-sector levies, emphasizing such actions would undermine City of London competitiveness and stall growth.

At the BoE, Andrew Bailey rebuffed Reeves’ critique while acknowledging some regulatory tweaks may be warranted—but he defended core rules like bank ring‑fencing as essential to financial stability. Meanwhile, Alan Taylor flagged downside risks to growth and urged more rate cuts—even as inflation persists.

Visit here to read finance updates on our finance news section.

Eyes on August 7 Decision

With this mix of tepid growth, wage pressure, and lagging inflation, the upcoming August 7 BoE decision will be intensely scrutinized.

- If the BoE cuts rates again, it signals that the slowdown in jobs and muted output growth carry more weight than high headline inflation.

- If no cut occurs, it suggests the inflation threat retains primacy—potentially exacerbating the slowdown by reinforcing a restrictive borrowing environment.

Markets currently favor another cut next month, with potential for one more before year-end

What It Means for Businesses and Consumers

- Businesses: Rate cuts ease finance costs, which helps capital investment and consumer financing. But ongoing cost pressures from taxation and wages mean many firms must still navigate tight margins.

- Consumers: Lower rates could reduce mortgage burdens and credit costs—boosting disposable income. Yet, with slower wage growth and higher taxes, many households may continue to hold back.

- Investors/Economy: Continued weakness could prompt a reassessment of UK asset classes. Equities tied to domestic spending may underperform, while bond markets may adjust to a prolonged easy-rate environment.

BoE commentary will matter too. If officials cite persistent inflation or flag upside risks, markets could rethink the pace of cuts, potentially jolting sterling and yields.

A Wider European Lens

The UK’s troubles reflect broader EU concerns:

- EU firms face export headwinds as Chinese price competition intensifies

- Eurozone growth has shown similar sluggishness, evidenced by recent PMI numbers and cautious ECB messaging

- Geopolitical tension and supply-chain instability are also weighing on investment sentiment, highlighting global linkages in this economic malaise..

Looking Ahead: Key Risks and Scenarios

- Soft Landing, Sustained Weakness

In recent BoE cuts rates on August 7 consecutive second time in 2025. Growth stands at around 1%, inflation gradually returns to target, and unemployment modestly rises. Households see some relief in borrowing costs. - Inflation Resurgence, No Cut

Data show inflation stabilises or rises (e.g., due to imported energy/food shocks). BoE pauses or reverses plans, leaving rates unchanged. Growth downwards further, increase risk of recession — but inflation concerns prevent rapid easing. - Twin Threat: Slow Growth + Sticky Inflation (“Stagflation”)

Labour market sickness limits consumption, yet inflation remains entrenched. BoE is compress between manage demand and battle with inflation, with little firepower to do either. - External Shock

A major Global event like demand supply disruptions, geopolitical tensions between major economy, or financial contagion—upends both demand and price stability. The UK’s weak starting point makes it vulnerable.

What Readers Should Watch Next

- August 7 BoE rate decision and accompanying Policy Report (especially the summary of economic projections and bank commentary on labour and inflation).

- Updates to PMI and employment data, especially if the next month shows further deterioration.

- Sterling and bond markets, which will reflect whether investors believe in the BoE’s commitment to combating inflation or shifting to stimulus.

- Government fiscal signals—especially if Chancellor Reeves responds to business pressure by reversing tax settings or announcing new economic incentives.

At the broad point of view emerging from the PMI and labour data is unmistakable and critical as per the economy is concerns: UK businesses are struggling. With hiring frozen and output stagnant, the BoE finds itself between Scylla and Charybdis—cutting rates risks fueling inflation, while holding fire deepens the economic chill.

Frequently Asked Questions (FAQs)

The Bank of England’s Monetary Policy Committee (MPC) voted to cut the Bank Rate by 0.25 percentage points to 3.75%, reflecting the continued easing of monetary policy as inflation slows.

The decision to lower the base rate came after a larger-than-expected decline in UK inflation, reducing market pressure for tighter policy and making a rate cut to support the economy more likely.

The MPC vote was narrow (5-4), reflecting a divided committee, with some members more cautious about future cuts while others insisted on easier monetary conditions.

Lower bank rates generally make mortgages and loan costs cheaper, while interest rates on savings may also fall – but changes happen gradually through banks and vary by product.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.