Most people associate money with wealth. But there is one big difference. Money is simply a medium of exchange, a unit that you collect, spend, save. Wealth is the ability to generate lasting value, creating systems, assets and flows that create more value over time – on a permanent basis rather than short-term accumulation.

As Coach BSR emphasizes in his talk, the shift from “making money” to “creating wealth” starts in mindset; It’s about creating something from nothing, taking advantage of starting small and moving forward sustainably.

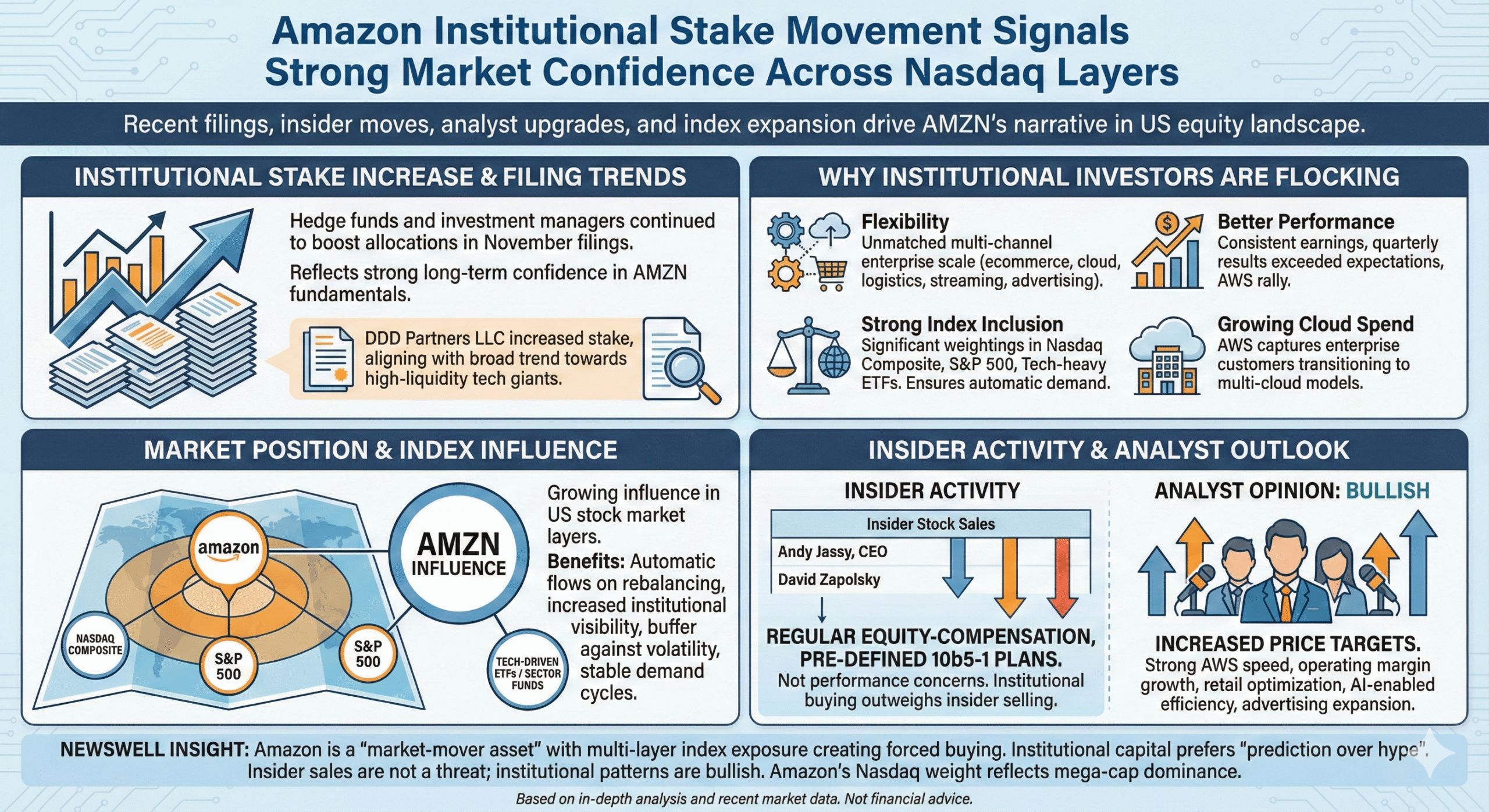

Reference :

Create WEALTH Not Money : How to Build Wealth From Nothing Ft. Coach BSR | Deep Cast Ep 41

What does “wealth” mean (vs money)

Creating wealth rather than simply accumulating wealth means you are focusing on value creation, leverage, wealth accumulation, time-freedom and compounding. Some key differences:

Money is transactional: you exchange work/time for money, you spend it, you save it. But if you stop working the flow may stop.

Wealth involves leveraging assets (systems, business, intellectual property, networks) so that your time is no longer the only limiting factor – you create something that works for you, not just you working for it.

Wealth is sustainable and scalable: you create something that continues to generate value (passively or semi-actively) and can outlive you.

Wealth often requires ownership of property or equity, or control of the system, rather than simply being a salary-earner.

The path to building wealth from nothing requires mindset, strategy, risk tolerance, a long-term view and often starting small but thinking big.

Coach BSR emphasized in his speech that many people pursue “more money” but not building wealth – they remain stuck in the cycle of “time for money.” The goal is to move to “money for time” and ultimately “time for money” – that is, freedom. (Although I can’t quote the video exactly here, that’s the gist of the change it discusses.)

Mindset Shift: Foundations

Here are some of the key mindset shifts that the “create wealth from nothing” philosophy demands:

Start with value, not cost

Instead of asking “how much less capital can I use” ask “how much value can I create”. Money is a by-product of value creation.

Be comfortable starting small and working up to scale

You can start with zero or minimal capital, but you have to build up from there. Wealth is not made overnight. This is a combination process.

Leverage System, Not Pure Effort

If you rely only on your time and energy, growth is limited. You have to create systems (automation, business models, network effects) that drive impact.

Own property/equity/intellectual property

Building wealth often requires that you own or have control over the asset (e.g. brand, product, business) rather than simply being a contractor or employee.

Think long term and holistically

Wealth is built through compounding – time + stability + reinvestment. Instead of chasing quick money, focus on lasting value.

Be flexible and adapt

Starting from scratch involves risk and challenge. The difference between those who build real wealth and those who don’t often comes down to resilience, learning from failure, and moving on when needed.

Strategies for Building Wealth from Zero – Actionable Steps

Here are practical strategies, geared toward someone who may have limited upfront capital, but high drive (e.g. you’re working in content/crypto/blogging). Each step is accompanied by a description of how you can implement them.

Strategies for Building Wealth from Zero – Actionable Steps

Here are practical strategies, geared toward someone who may have limited upfront capital, but high drive (e.g. you’re working in content/crypto/blogging). Each step is accompanied by a description of how you can implement them.

Strategy 1: Build a platform or presence

Whether you’re creating a blog, Telegram channel, YouTube channel, podcast, or marketing materials, you’re creating a platform. Platforms are assets: they attract attention, authority, influence. Once created, they allow you to monetize in multiple ways (advertising, signals, affiliate, product, service).

How do you implement it: You already run a Telegram channel for crypto signals and plan a blog. Treat both as brand-assets, not just tools. Grow your audience, deepen engagement, establish authority. It becomes an asset that you can monetize and grow.

Strategy 2: Use leverage and technology

Leverage can be time-leverage (automation, outsourcing) or scale leverage (platform effects, network effects). Use technology to reduce each user’s marginal cost.

How you implement it: For your blog, automate publishing workflow, cross-post to LinkedIn/Telegram, reuse content. For Telegram Signal channels, consider building a subscription and referral model beyond just manually posting.

Strategy 3: Reinvest Profits and Compound

When you earn, reinvest part of the profits into growth (marketing, better tools, higher quality content) instead of just spending it. Compounding means that your “wealth” gets bigger.

How you implement it: Let’s say you monetize your blog with AdSense + affiliate links + premium signals. Initially invest 30-50% of earnings in SEO, content, plugins, email capture, paid ads. With time, your channel/blog will grow rapidly.

Strategy 4: Diversify Your Revenue Streams

Wealth is not created from any one source of income. You want multiple streams – product, service, inactive, membership, affiliate. Diversification makes assets more robust.

How you implement it: For your crypto/trading area: signals (memberships), blogs (advertising, affiliate brokers), education/courses (digital products), community (premium groups). Each adds another revenue stream, and the sum is greater than the parts.

Strategy 5: Choose the right opportunity/domain

Coach BSR emphasizes that starting from nothing sometimes means entering underserved areas or markets where you can create disproportionate value. Instead of chasing commodity markets, find leverage.

How you apply it: For example, you can specialize in “Crypto Trading Psychology for Indian Audience” or “Education + Blog Combo for Crypto Signals + Telegram”. A specific authority scale would be better than a generalist one.

Strategy 6: Measure and optimize for value-creation

Building wealth means being rigorous about the metrics that matter – audience growth, engagement, conversion, retention, customer lifetime value – not just “money in the bank today.”

How you implement it: Track your blog traffic sources, bounce rates, email list growth; Track Telegram subscriber growth, engagement, retention; Track conversions of blog → product → up-sell. Make these metrics your guiding KPIs.

Recent Business Examples: Creating Real Assets From Nothing

Let’s look at some recent real-world examples (India-side and global) of businesses that demonstrate “wealth creation” (not just money) – some started with less resources, scaled up, created assets, created value.

Example 1: Milk Mantra (India)

Established in Odisha in 2009, Milk Mantra is a dairy/health-food company that grew from regional roots and became a premium brand.

Initially founder Shrikumar Mishra and team dealt with the problems of milk quality, farmer sourcing, packaging.

They pioneered “ethical milk sourcing” (“Happy farmers = happy cows = best milk!”) and packaged their brand as premium, health-oriented.

They reinvested, built the brand, scaled up their operations, built an asset (‘Milky Moo’ brand + manufacturing + distribution + D2C app) and were acquired in January 2025 for ₹233 crore – indicating wealth earned, not just low income flows.

Lesson: They moved beyond bi-directional value creation (farmer + brand) and built infrastructure + brand equity. That is wealth creation.

Example 2: Archean Foods Pvt Ltd / Lahori Jeera (India)

The latest example of a small beginning turning into a big empire. These three cousins launched a desi-beverage brand (at Rs 10 a bottle) in 2017, and aim to reach ₹312 crore revenue by 2024, with a target of ₹1,000 crore by FY26.

Why it matters: They started small, picked a niche ignored by the big players (ethnic fizzy drinks), built distribution, brand, value. That’s money – not just earned cash – but an enterprise asset.

Lesson: Opportunity + Niche + Brand + Scale = Money.

Common pitfalls to avoid

When transitioning from making money to building wealth, here are the traps highlighted by Coach BSR that many people don’t avoid:

Chasing quick money instead of building systems: If you only focus on quick signals/subscriptions, you may neglect building your blog, email list, brand.

Failing to reinvest: Many people take the initial profits as consumption and do not develop the platform.

Excessive leverage or excessive borrowing: Starting from zero means you are more vulnerable; Avoid large debts unless you have a strong system in place.

Not owning your audience or platform: If you rely on a platform you don’t control (for example, Telegram) without building your own email list/brand, you’re at risk if you change platforms.

Ignoring long-term value: Some people focus only on current income but ignore retention, churn, brand equity, product quality.

Not adapting: markets change (crypto regulation, SEO algorithm, platform rules). If you don’t optimize, you may lose value.

Closing of Thoughts

“Creating wealth, not money” is both a mindset and a methodology. It demands that you start right where you are (even with nothing), create value, create leverage systems, build your wealth, achieve compound growth and play the long game.

For you, given your context in crypto marketing, Telegram signals, blogging, and LinkedIn, you are in a strong position: you already have a niche audience, you are producing content regularly, you are building digital assets. The next step is to consciously shift from “just earning income” to “building an asset-based business” – a business that can scale, diversify, survive shocks and ultimately work beyond your time.

For more such content follow Newswell.info and visit Coach BSR and Deepak Daiya 2.0 Podcasts