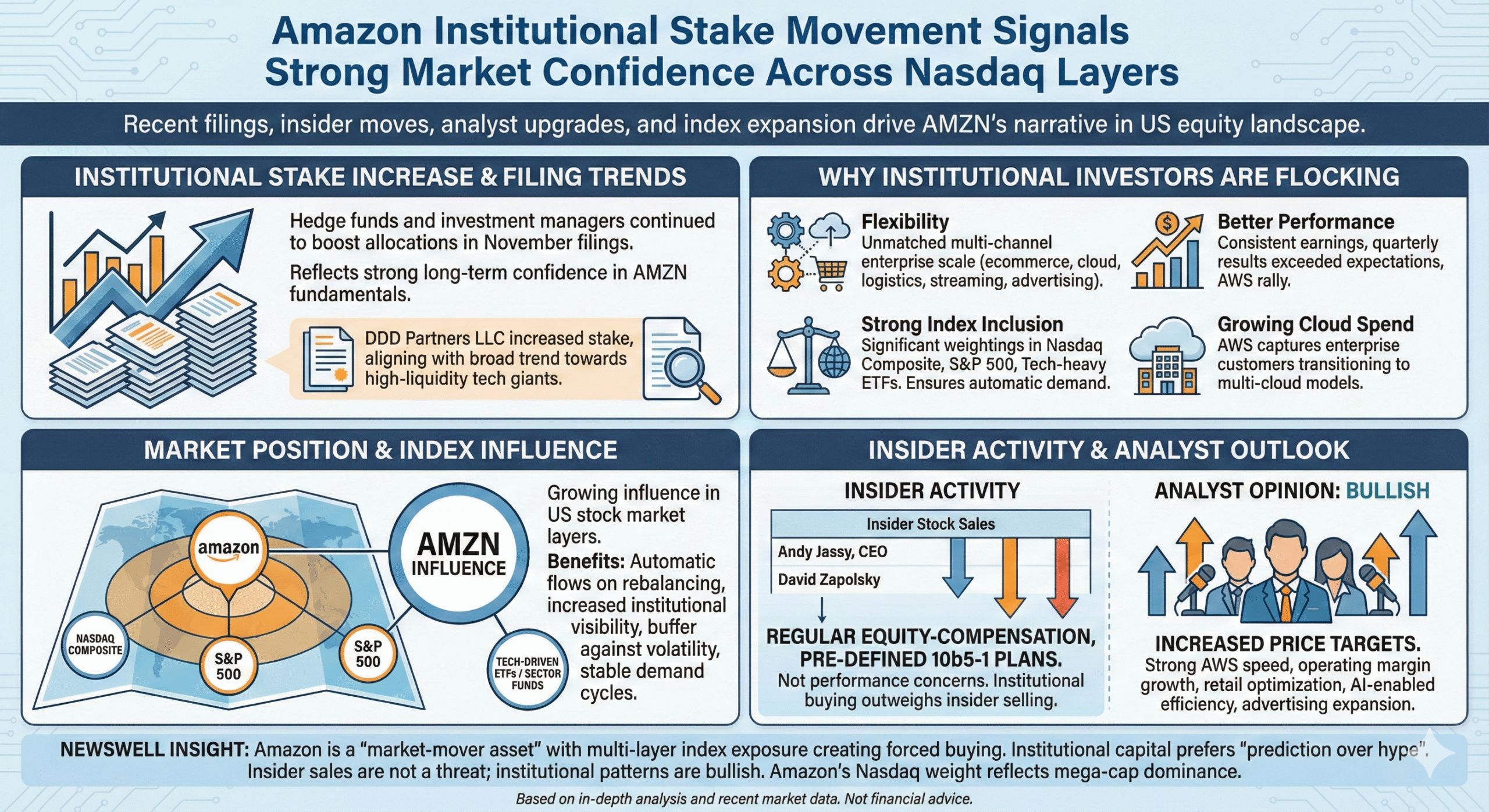

Amazon Institutional Stake Movement Signals Strong Market Confidence Across Nasdaq Layers

In the ever-changing US equity landscape, few companies are gaining institutional conviction like Amazon.com, Inc. as powerfully depicted. Recent filings and market data reveal a sharp increase in institutional interest – complemented by strategic insider moves, analyst upgrades and Amazon’s expanding footprint in major market indices. Together, these create a compelling narrative of how AMZN advances the digital-retail ecosystem and impacts the broader Nasdaq Composite, S&P 500 and multi-sector investment strategies.

This in-depth newswell-style report explores the key developments, fund movements, insider activities, index exposures and growth signals shaping Amazon’s 2025 outlook – supported by trending keywords such as Amazon institutional stake disclosure, institutional holdings trend, Amazon multi-channel enterprise, insider sales at Amazon and Amazon index-linked strategy.

Institutional stake movement: A deeper look at the filing increase

In November, institutional filings highlighted a notable development: Hedge funds and investment managers continued to boost their Amazon allocations, reflecting strong long-term confidence in AMZN’s fundamentals.

One of the standout data points came from DDD Partners LLC, which increased its stake in Amazon in its latest SEC filing. The move is in line with a broader trend of funds strengthening exposure to high-liquidity tech giants, particularly companies strongly embedded within the US index framework.

Why are institutional funds flocking to Amazon?

Institutional investors look at the following factors:

- Flexibility in the retail-digital ecosystem

Amazon’s ability to combine ecommerce, cloud services, logistics, streaming, and advertising creates an multi-channel enterprise that is unmatched in scale.

- Better performance with consistent earnings

AMZN’s recent quarterly results exceeded Wall Street expectations, with AWS rallying after a soft 2023 cycle.

- Strong Index Inclusion Strategy

Amazon maintains significant weightings in the Nasdaq Composite, S&P 500 and various tech-heavy ETFs – ensuring automated demand from index funds and sector allocators.

- Growing share of enterprise cloud spending

AWS continues to capture enterprise customers transitioning to a multi-cloud model.

These points make Amazon the default long-term compounder in many institutional portfolios.

Amazon’s market position: Nasdaq, S&P and multi-sector indices

One of the most insightful aspects revealed through institutional disclosures is Amazon’s growing influence in many layers of the US stock market – particularly through index weightings.

Amazon ranks heavily in:

- nasdaq composite

- S&P 500

- Technology-Driven ETFs

- consumer-discretionary sector fund

- growth oriented index fund

Why does this matter to investors?

- Amazon’s overweight position ensures:

- Automatic flows every time the ETF is rebalanced

- Increase institutional visibility

- A buffer against volatility due to passive fund stability

- Stable demand cycles in index-linked strategies

This cross-segment exposure makes Amazon an essential asset for funds seeking broad-based US market exposure.

Insider activity: Amazon executives’ activity

Along with institutional accumulation, insider activity provides another layer of insight.

Recent filings show stock sales by key Amazon leaders, including:

- Andy Jessie, Chief Executive Officer

- David Zapolsky

Should investors worry about insider selling?

Insider selling often creates speculation, but in the context of Amazon, the steps appear to be as follows:

- regular equity-compensation related

- Structured through pre-defined 10b5-1 trading plans

- Doesn’t reflect broader concerns over Amazon’s approach

Newswell’s analysis shows that insider sales at large-cap tech companies are usually related to liquidity planning rather than performance concerns.

Institutional buying that outweighs insider selling is often seen as a net positive sign.

Analyst Opinion: Bullish with increased price target

Another trending theme is the wave of analyst upgrades. Several equity research firms have raised their price targets for AMZN, citing the following:

- strong aws speed

- increase in operating margin

- Retail Optimization and Automation

- AI-enabled efficiency in logistics

- Expansion of advertising revenue

Analysts widely classify Amazon as a mega-cap, reinforcing institutional accumulation trends.

Amazon’s business fundamentals strengthen institutional confidence

A key part of why Amazon continues to attract institutional attention lies in its business fundamentals.

1. AWS: The backbone of Amazon’s growth

AWS remains Amazon’s most profitable segment, contributing significantly to operating income. Enterprises increasing cloud spending and adopting AI workloads strongly support AWS revenue acceleration.

2. Retail + Logistics: Reinventing Efficiency

Amazon’s ongoing shift from regional to localized delivery centers has reduced delivery times and service costs.

3. Advertising: The fastest growing segment

Amazon’s advertising platform has become a major revenue driver, surpassing many global advertising networks.

4. Multi-Channel Enterprise Advantage

Institutional investors prefer companies with diverse income streams – and Amazon’s ecosystem is a mixed one:

- ecommerce

- clouds

- Subscription Services

- Fintech (payments, lending)

- logistics

- AI and automation

This positions Amazon as a flexible compounder for long-term portfolios.

NewsWell Insight: The big picture of Amazon’s institutional trends

Here are unique analytical insights inspired by NewsWell’s research style, designed to add depth beyond standard news reporting:

1. Amazon is becoming a “market-mover asset”

Institutional ownership levels and index weightings show that Amazon has now developed into a market-moving asset. Movements in AMZN can have a meaningful impact on technical indices and even shape ETF performance.

2. Multi-layer index exposure creates forced buying

As more thematic ETFs launch around AI, cloud, ecommerce and logistics, Amazon’s inclusion forces automated buying from fund managers – giving AMZN a structural demand advantage.

3. Institutional money prefers “prediction over hype”

Unlike speculative AI startups, Amazon offers institutional investors predictable cash flows, diverse revenue pillars, and strong market presence. That’s why capital continues to flow into AMZN.

4. Insider sales are not a threat

Newswell’s analysis shows that insider selling has no correlation to future stock declines in stable mega-caps like Amazon. Instead, institutional buying patterns have more predictive power – and current patterns are highly bullish.

5. Amazon’s weight in the Nasdaq reflects a larger trend

Amazon’s growing influence on Nasdaq levels reflects a broader shift in market structure where mega-caps dominate index performance, making them indispensable to both passive and active funds.

The recent increase in institutional filings, coupled with Amazon’s growing influence at key market levels, solidifies the company’s position as a long-term market driver. With analysts raising price targets, AWS bullish, and index-linked funds increasing exposure, Amazon stands out as a powerful force on the Nasdaq Composite and beyond.

As markets evolve toward AI-driven efficiency and digital-commerce dominance, Amazon’s multi-channel ecosystem gives it an enduring competitive advantage – making institutional accumulation logically and strategically timed.

This unique NewsWell-style analysis highlights Amazon’s growing importance not just as a company, but as a cornerstone of the global market infrastructure.