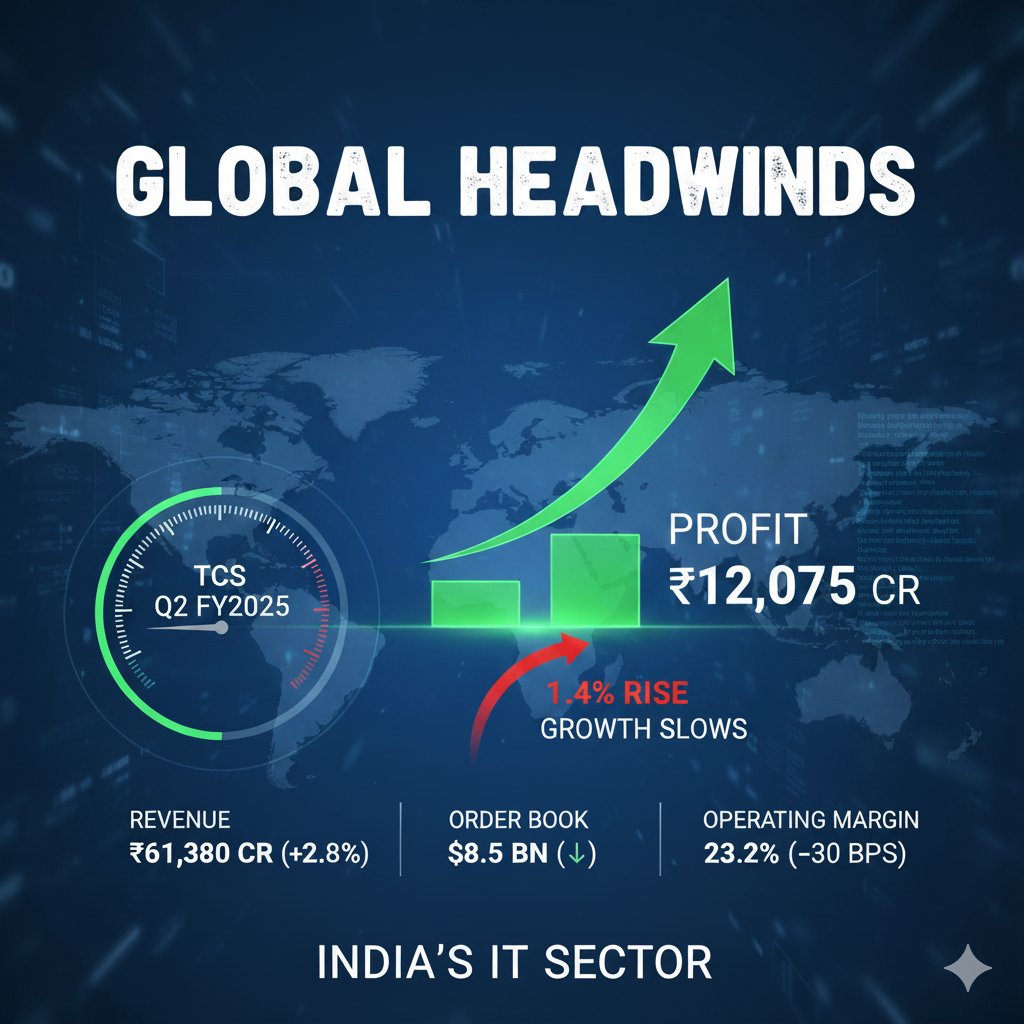

Tata Consultancy Services (TCS), India’s largest IT services company, reported its Q2 FY2025 results on October 8, 2025, which showed modest growth that fell slightly below market expectations. While revenues grew in line with forecasts, the company’s net profit rose 1.4% year-on-year to ₹12,075 crore, indicating a cautious outlook as global tech spending remains under pressure.

Despite headwinds in the global economy, TCS remains optimistic about long-term digital transformation opportunities and its strong deal pipeline. Let’s take a closer look at the highlights, performance metrics, business challenges and what these results mean for India’s IT sector at large.

TCS Q2 FY2025 Highlights at a Glance

| Parameter | Q2 FY2025 | Q2 FY2024 | Change (YoY) |

| Revenue | ₹61,380 crore | ₹59,692 crore | +2.8% |

| Net Profit | ₹12,075 crore | ₹11,846 crore | +1.4% |

| Operating Margin | 23.2% | 23.5% | -30 bps |

| EPS (Earnings per Share) | ₹33.10 | ₹32.65 | +1.3% |

| Order Book | $8.5 billion | $10.2 billion | ↓ |

Slow growth but stable margins

TCS’s second quarter performance reflects a slow recovery phase for the global IT sector. While the company maintained healthy profitability, revenue growth slowed due to spending cuts by customers in North America and Europe, particularly in the BFSI (banking, financial services and insurance) and retail sectors.

The company’s operating margin came in at 23.2%, down slightly from the previous quarter but still one of the best in the IT industry. According to CEO and MD K Krittivasan, “The environment remains uncertain, but our strong execution and customer relationships are helping us navigate the challenges for future growth.”

Key factors behind performance

1. Macro headwinds are impacting demand

The slowdown in global economies—particularly the US and Europe—has led to a decline in discretionary IT spending. Clients are prioritizing cost optimization projects rather than large-scale digital transformation initiatives. TCS cited delays in deal ramp-up and slow project starts in key markets.

2. Strong domestic momentum

India remains a bright spot for TCS. The company witnessed double-digit growth in domestic business driven by government, telecom and financial services projects. Digital India initiatives and AI-driven modernization programs have helped offset the international slowdown.

3. Deal Wins and Pipelines

While total contract value (TCV) for Q2 was $8.5 billion, down from the $10.2 billion booked last year, the pipeline remains strong. TCS signed several notable deals in cloud transformation, data analytics and AI services in industries like healthcare, manufacturing and retail.

4. Employee Productivity and Attrition

TCS continues to manage attrition effectively. The voluntary attrition rate fell to 12.3%, one of the lowest in the last few quarters. The company added 5,500 new employees in the second quarter, bringing its total to 623,200 globally.

“Our continued investment in upskilling and employee engagement is paying off as we see headcount returning to normal and morale across teams improving,” said Milind Lakkad, chief human resources officer.

Segment-wise performance

1. BFSI (Banking, Financial Services, Insurance)

It is TCS’s largest vertical, contributing about 32% to revenues. However, the segment witnessed slow growth due to macroeconomic uncertainty in western markets and delays in decision making by large banking customers.

2. Retail and CPG

The retail and consumer packaged goods segment continues to face challenges as US and European customers cut discretionary IT budgets. However, TCS is betting on AI-led personalization and supply chain transformation projects to regain growth momentum in this sector.

3. Manufacturing

The manufacturing sector recorded moderate growth due to increased automation and digital engineering projects. TCS’s involvement in Industry 4.0 and IoT is continuously increasing.

4. Life Sciences and Healthcare

The segment delivered stable performance supported by data analytics and compliance transformation deals. The pandemic-driven focus on healthcare digitalization remains a key growth driver.

5. Communication, Media and Technology

The CMT segment grew marginally due to demand from telecom customers amid 5G rollout and media firms adopting AI-based content management solutions.

Geographical Performance

| Region | Growth (YoY) | Remarks |

| North America | +1.0% | Impacted by client spending cuts |

| Europe | +0.8% | Economic slowdown; deal delays |

| India | +14.2% | Strong domestic demand |

| Asia Pacific | +3.7% | Stable growth |

| Latin America | +4.5% | Gradual recovery |

TCS is facing headwinds in its key markets – the US and Europe – which together contribute more than 70% of its revenues. However, the Indian market is emerging as a powerful growth engine driven by public sector and infrastructure digitization projects.

AI, cloud and emerging technologies are driving the future

Despite the recession, TCS continues to invest heavily in AI and cloud transformation. The company launched several new AI-powered tools for software engineering, customer analytics and business operations automation. Its AI platform, TCS Generative AI, is now being deployed in many client projects to improve productivity and reduce costs.

The management also highlighted that more than 35% of TCS’s revenue now comes from digital services, including cloud, AI and analytics. This transformation marks TCS’s continued evolution from a traditional IT services provider to a strategic technology partner for global enterprises.

Management Comment: Focus on long-term growth

At the post-results press conference, CEO K Krithivasan and CFO Sameer Seksaria emphasized resilience and operational discipline as key themes for the coming quarters.

Krithivasan said,

“While short-term volatility persists, the long-term demand for digital transformation remains intact. We are investing strategically in AI, cloud, and sustainability to ensure we are future-ready.”

Seksaria added,

“We continue to maintain a strong balance sheet, with cash and equivalents of over ₹75,000 crore. Our cost optimization measures are helping sustain healthy margins despite pricing pressure.”

TCS Dividend and Shareholder Returns

Along with its Q2 results, TCS declared a second interim dividend of ₹9 per share. The company has been consistent in rewarding shareholders, maintaining its reputation as one of India’s most trusted blue-chip stocks.

TCS shares closed marginally lower at around ₹3,830 per share on the NSE after the results, as investors reacted to the earnings miss and cautious commentary. However, analysts remain optimistic about TCS’s medium-term outlook due to its strong customer base, operational excellence and strong balance sheet.

Analyst Views: Conservative short-term, bullish long-term

Market analysts said although the results were slightly below expectations, TCS is well positioned for a recovery once global IT budgets stabilise.

Kotak Institutional Equities said: “Despite macro challenges, TCS has maintained margin discipline and steady deal pace. We expect a gradual recovery from Q3 onwards.”

ICICI Securities said: “A focus on AI-driven efficiencies and cost optimization should deliver benefits in FY26.”

Conversely, some brokerage firms like Motilal Oswal slightly lowered their near-term target prices citing weak revenue growth visibility.

Outlook: Resilience amid uncertainty

The IT industry is currently going through a challenging phase, marked by an economic slowdown, cautious enterprise spending and pricing pressure. Nevertheless, TCS’s solid fundamentals, diverse portfolio and commitment to innovation make it one of the most resilient players globally.

Going forward the company is expected to benefit from:

- Adoption of AI and automation across sectors

- India’s growing domestic digital market

- Global IT sentiment to improve in 2026

If macroeconomic environment improves, TCS may return to double digits

TCS’s Q2 FY2025 performance outlines a transitional phase for the Indian IT giant. While growth has slowed amid global uncertainty, the company’s financial strength, focus on innovation and operational discipline shine through.

As digital transformation remains an irreversible trend, the long-term story of TCS remains strong. For investors, the stock may remain a defensive bet in turbulent markets, backed by solid cash flows, consistent dividends and unmatched global credibility.